How much can you normally borrow for a mortgage

You should expect to borrow 60-75 of the value of the property. If youre taking out a.

Payday Installment Loan Singapore Money Lender Installment Loans Loan Consolidation

Theyll also look at your assets and debts your credit score and your employment.

. Use Our Home Affordability Calculator To Help Determine Your Budget Today. If youre concerned about any of these talk to. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

The first step in buying a house is determining your budget. Your salary will have a big impact on the amount you can borrow for a mortgage. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

Your total household expense should. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

The Search For The Best Mortgage Lender Ends Today. This ratio compares the amount you hope to borrow with how much the property is worth. Ad Calculate How Much Mortgage Can You Afford Backed By Top Mortgage Lenders Save.

So if youre wondering how much mortgage can I get youre asking the wrong. The mortgage amount you can borrow is not necessarily the mortgage you can afford. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

Now lets say youre teaming up with someone else to get a. For example if you make 3000 a month 36000 a year you can afford a mortgage with a monthly payment no higher than 1080 3000 x 036. Check your mortgage eligibility options today.

Conversely if you keep your debt low you might be able to borrow as much as 6 times your salary for a mortgage. This mortgage calculator will show how much you can afford. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more.

Were Americas 1 Online Lender. Unlike other types of FHA loans the maximum. Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily.

The more you put toward a down payment the lower your LTV ratio will be. How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself. Find out how much you could borrow.

Check Eligibility for No Down Payment. Your maximum borrowing capacity is approximately AU1800000. Ad The right loan can make all the difference.

Ad Compare Best Mortgage Lenders 2022. Compare More Than Just Rates. Were Americas 1 Online Lender.

The optimal amount for the best possible mortgage deal is 40 per cent. Find A Lender That Offers Great Service. Its A Match Made In Heaven.

BTL mortgages are considered a little riskier for lenders which means youll usually need at least a 25 deposit if not more. While you may have heard of using the 2836 rule to calculate. Ad Compare Mortgage Options Get Quotes.

The two examples above demonstrate how you could potentially increase your borrowing capacity 4x with some. The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Get Started Now With Quicken Loans.

Fill in the entry fields and click on the View Report button to see a. Specialized mortgage lenders available nationwide. So if your lender is prepared to let you borrow 90 per cent of the cost of the property but you can afford.

Compare - Apply Get Cheap Rates. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Contact a loan specialist.

As a general rule lenders want your mortgage payment to be less than 28 of your current gross income. Apply Online Get Pre-Approved Today. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

Get Started Now With Quicken Loans. Usually banks and building societies will offer up to four-and-a-half times the annual. The cap is usually between 80-85 with most lenders but there might be a few exceptions.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Its A Match Made In Heaven. Ad Compare Mortgage Options Get Quotes.

Ad More Veterans Than Ever are Buying with 0 Down. For this reason our calculator uses your. That means that on your own you can probably borrow around 108000 24000 x 45 108000.

How much can I borrow for a buy-to-let mortgage with Together. Say you earn 24000 per year. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

2 x 30k salary 60000. Looking For A Mortgage. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Want to know exactly how much you can safely borrow from your mortgage lender. Were Americas 1 Online Lender. When it comes to residential purchases the minimum deposit requirement is 5-10 and you wont usually need to provide more than that unless the lender considers you a.

Looking For A Mortgage.

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

I Make 75 000 A Year How Much House Can I Afford Bundle

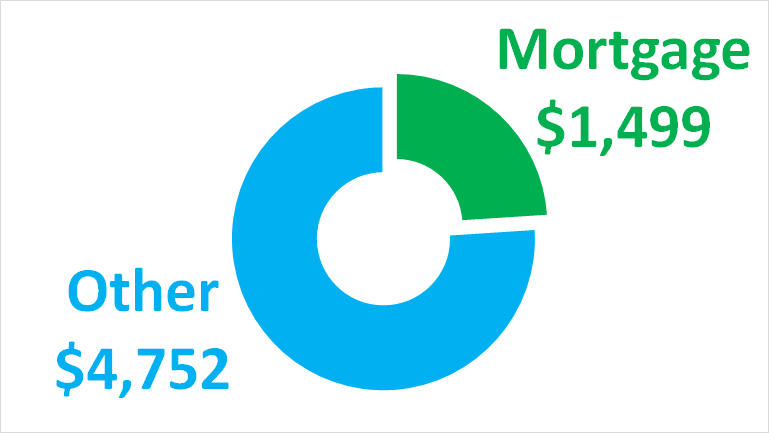

Mortgage Interest Calculator Principal And Interest Wowa Ca

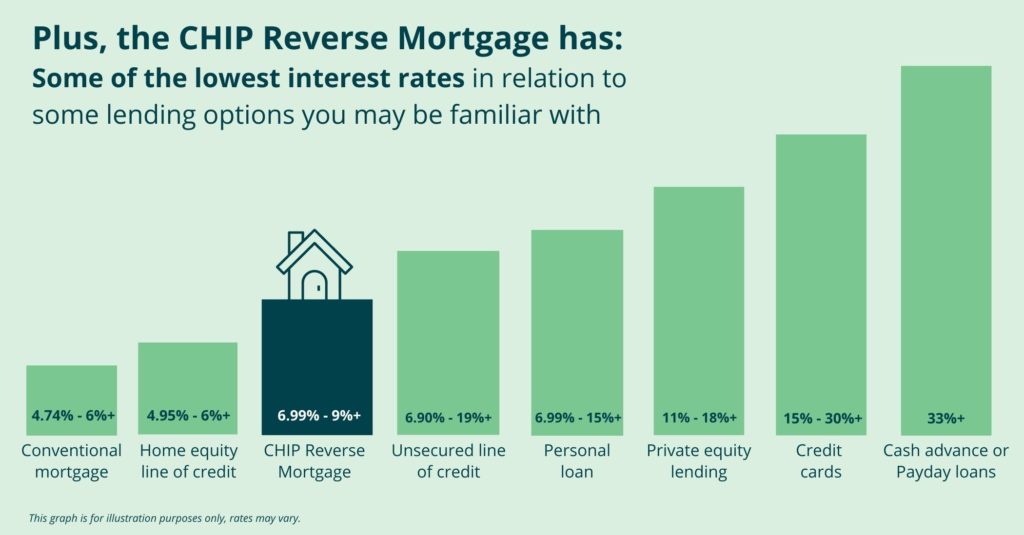

Chip Reverse Mortgage Rates Homeequity Bank

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Pre Qualification In An Informal Way To See How Much You May Be Able To Borrow You Can Be Pre Qualified Over The Mortgage Process Underwriting The Borrowers

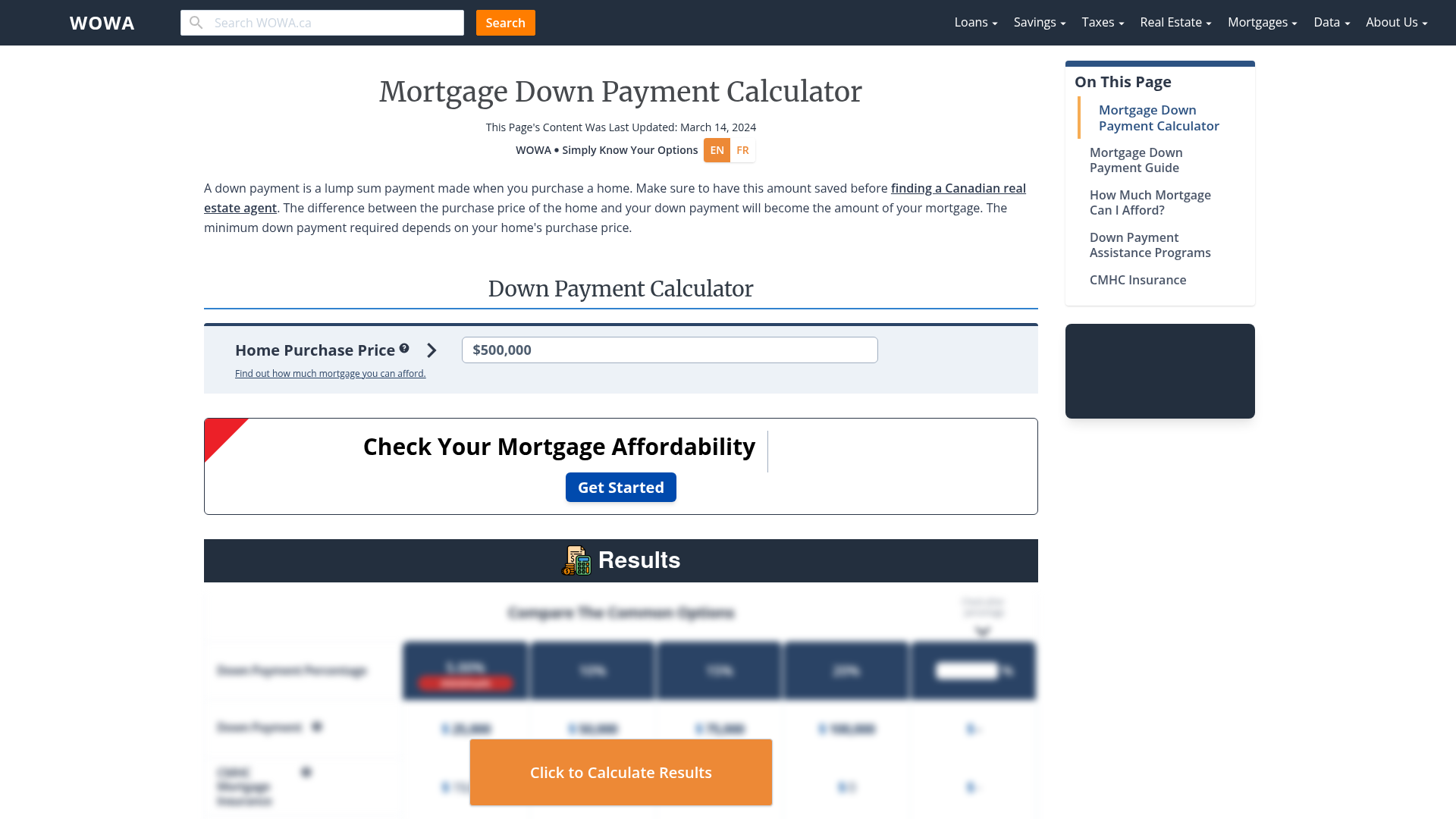

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

7 Step Mortgage Approval Process Canada

What Is A Mortgage

250k Mortgage Mortgage On 250k Bundle

Pin On Real Estate

How To Increase Home Loan Eligibility Onloine Home Loans Loan Increase

Money Tribune Income Tax Deduction For Home Loan Under Section 24 80c And 80ee Buying A Home Is A Costing Affair For Any Investing Income Tax Tax Deductions

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide